Participating provinces have entered into a federal-provincial agreement called the Comprehensive Integrated Tax Coordination Agreement (CITCA). The HST is levied by the Government of Canada, pursuant to the federal Excise Tax Act. What gives the province the authority to change the HST rate? The new HST rate of 15% is a combination of the 5% federal Goods and Services Tax (GST) combined with the 10% provincial portion. The HST operates the same way as the Goods and Services Tax (GST), which is in place across Canada and is applied to the same types of goods and services.Įffective July 1, 2016, the Government of Newfoundland and Labrador increased the provincial portion of the HST from 8% to 10%. Newfoundland and Labrador has been an HST participating province since July 1, 1997. Most goods and services supplied in Newfoundland and Labrador are subject to the Harmonized Sales Tax (HST). The Harmonized Sales Tax (HST) is a value added tax that combines the provincial sales tax with the federal Goods and Services Tax (GST), to create a single, federally administered HST. Newfoundland and Labrador Statistics Agency (NLSA).Treasury Management and Budgeting Branch.Policy, Planning, Accountability and Information Management Division.Real Gross Domestic Product (GDP) Growth Forecast.The Newfoundland and Labrador Child Benefit (NLCB).NL Income Supplement and the NL Seniors’ Benefit.Credits, Benefits, Incentives and Rebates.Transitional Rules for the Newfoundland and Labrador HST Rate Increase.Retail Sales Tax on Automobile Insurance (Elimination) NEW!.Frequently Asked QuestionsRetail Sales Tax on Insurance Premiums.Labour-Sponsored Venture Capital Tax Credit.Economic Diversification and Growth Enterprises Program.

#CANADA REVENUE AGENCY TAXATION FOR FREE#

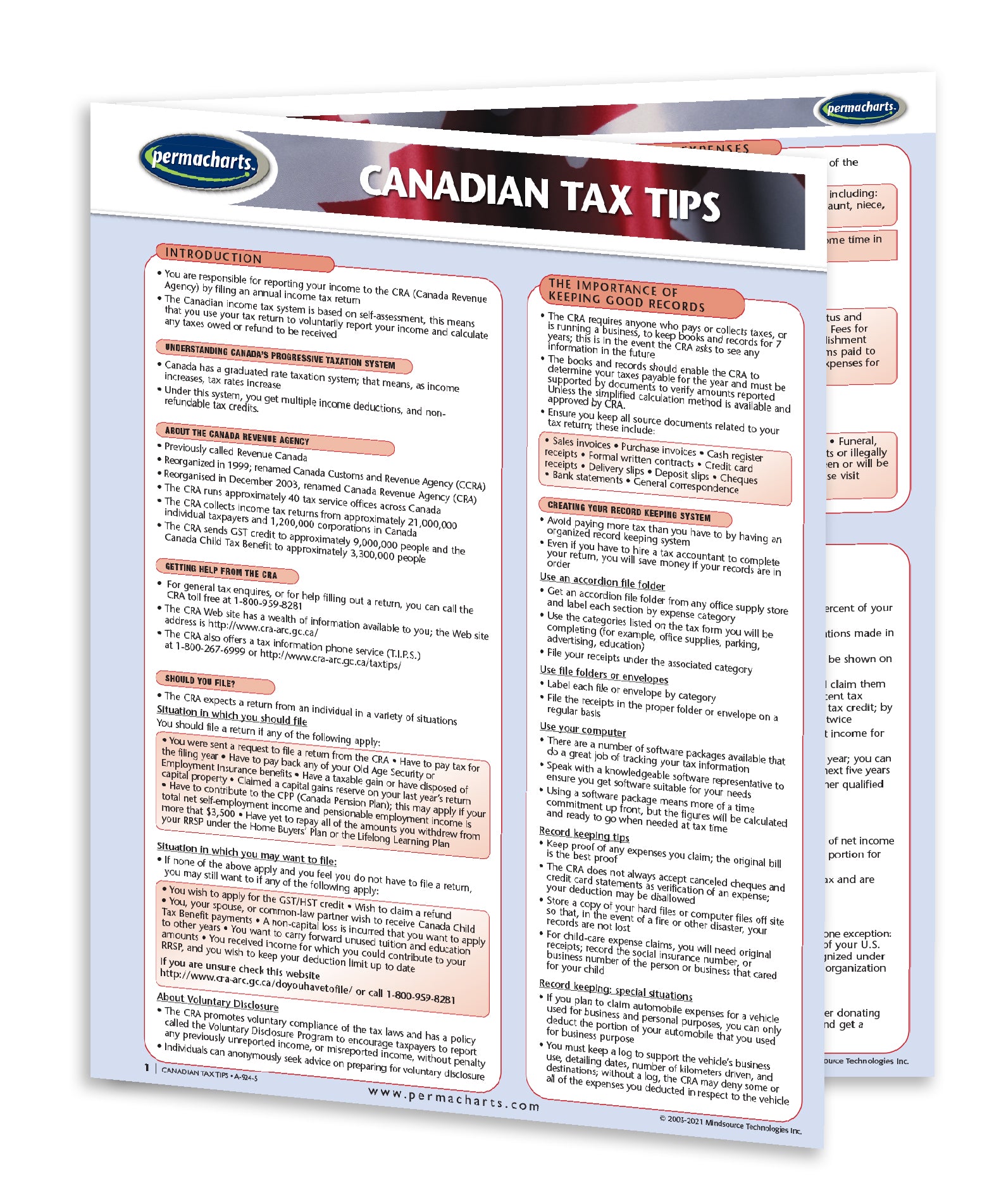

Get help filing your taxes for free on campus at a UTSU tax clinic appointment, or off campus at a free community tax clinic. The CIE does not offer one-on-one individual income tax filing support. Sign up for an information session or webinar below under Booking & Documentation or speak with an international transition advisor to learn what you initially need to know in order to file with the Canadian tax system. The Centre for International Experience (CIE) offers supportive programming to help along the way.

#CANADA REVENUE AGENCY TAXATION HOW TO#

See our Social Insurance Number clinics to find out how to get a SIN. You will need a Social Insurance Number (SIN) if you want to file an income tax return in Canada. You may be eligible for the GST/HST credit after your arrival in Canada and can apply prior to filing your income tax return.Īnother major benefit of filing an income tax return even if you did not earn any income is that you can carry forward your tuition credits to reduce your future income tax owed that can benefit you when you may earn more income later on e.g.

You can file online using certified tax software. If you do not owe any income tax, you can file an income tax return after this date and you may still be eligible for tax credits, benefits or a refund. 2020 tax filing deadline: The deadline to file a 2020 income tax return is April 30, 2021.

0 kommentar(er)

0 kommentar(er)